Medicare Supplement Plan N is a great option for beneficiaries who like the freedom to choose your own providers and don’t mind a small deductible and co-pays in exchange for a typically lower monthly premium.

With the Plan N, you will be responsible to pay your Medicare Part B deductible ($240 for 2024), you will also have co-pays that range between $0- $20 for doctor visits, and $50 co-pay for emergency room visits.

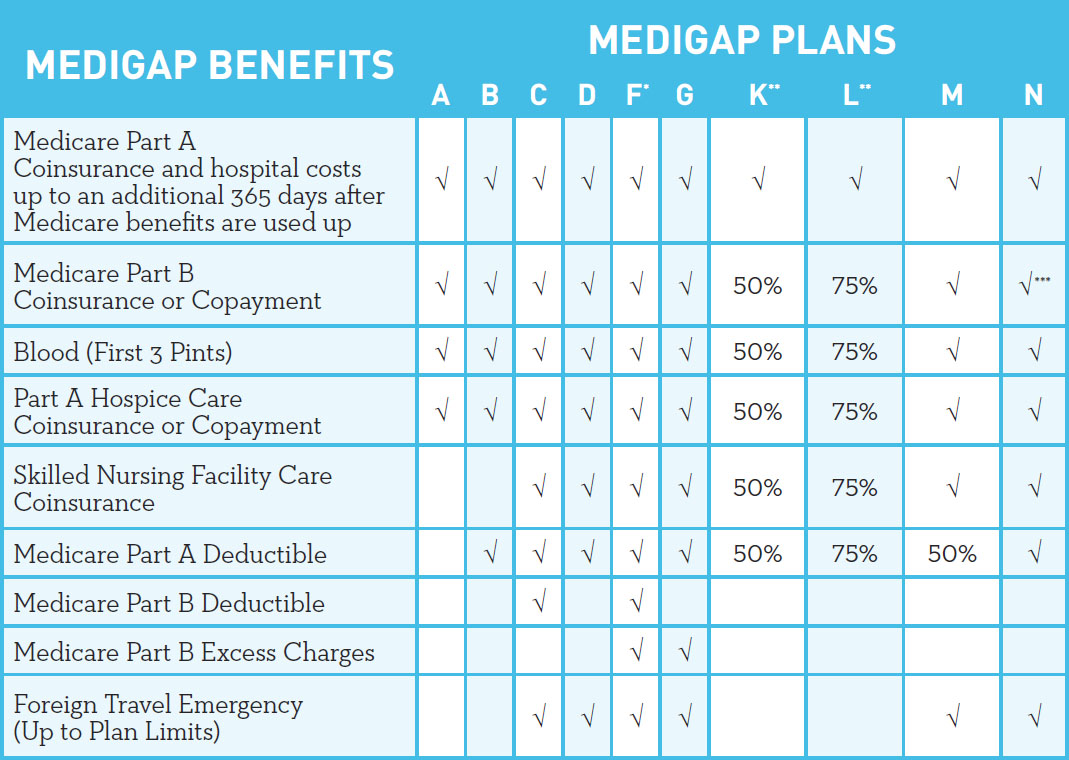

Beneficiaries with the Plan N will also be responsible to pay “excess charges” that some doctors may charge. Providers may charge patients up to 15% of what Medicare pays them for the service. However, if the physician accepts Medicare as full payment then you will never have to worry about excess charges. Please feel free to ask us if a provider accepts Medicare as full payment.

Mary wants freedom to go to any doctor she wants without having to worry about referrals. She also only goes to the doctor 2-3 times per year. She doesn’t mind a small deductible and co-pays especially if it will save her money with her monthly premium.

Mary needed to have an outpatient procedure done early in the year before she had met her deductible. She was responsible for her Part B deductible ($240) and was responsible to pay up to $20 co-pay per doctor visit after that. She only had 2 doctor visits that year which totaled her $40 in co-pays.

Since the Plan N does not cover excess fee’s, Mary may be hit with extra charges if her doctor does not accept Medicare as full assignment (payment). Thankfully her doctor does accept Medicare as full payment but lets pretend that he didn’t. If Mary’s doctor did not accepts Medicare as full payment then her may charge her up to 15% above what Medicare pays him for her visit. So for example, if Medicare’s assigned rate for a visit to Dr. Katz was $100, then he may charge Mary up to $15 for her visit to him. Mary would owe her $20 co-pay as as the $15 excess charge.

If you’d like a plan that covers excess charges then Plan F or Plan G are the way to go.