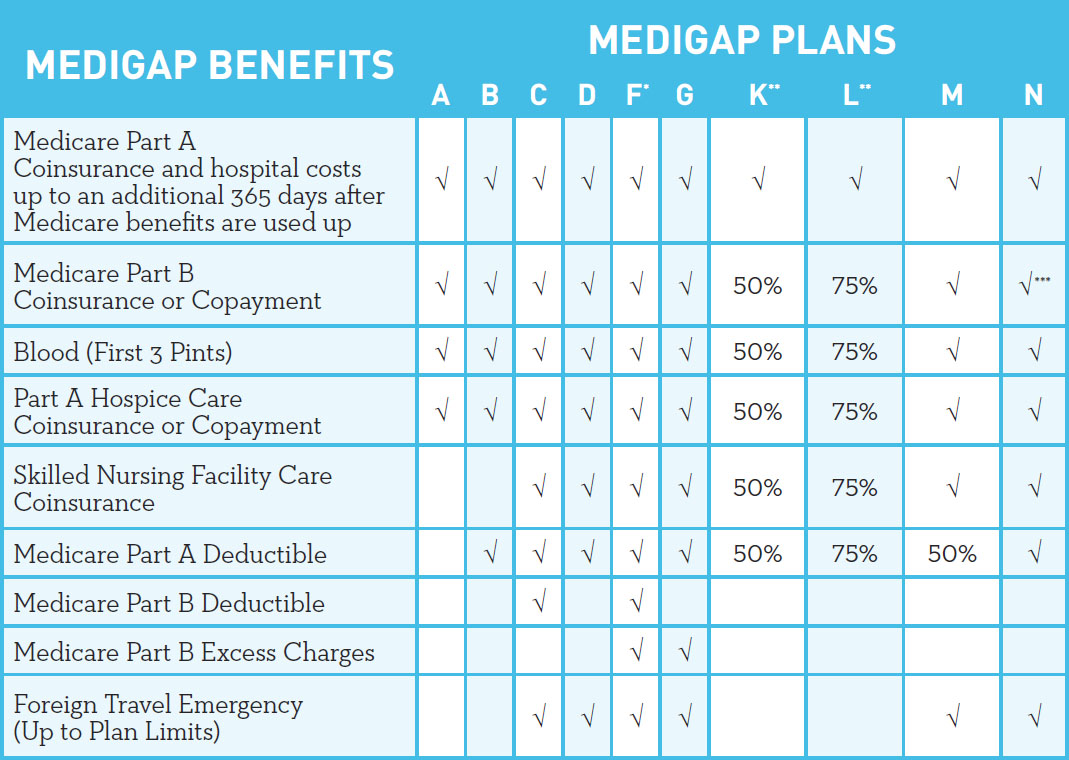

The Medicare Supplement Plan G may help cover the full of out-of-pocket Medicare expenses such as co-payments, coinsurance, and excess charges. Medicare Supplement Plan G is very similar to Plan F. However, with the Plan G, you are responsible for your Medicare Part B deductible. The Medicare Part B deductible in 2024 is $240. Once you meet your annual deductible, you are then covered at 100 % and will not be responsible for any co-pays!

Beneficiaries that are willing to pay a small deductible can usually save a substantial amount of money with the Plan G versus the Plan F.

Health insurers that offer Medicare Supplement plans can set their own premium rates, but the plans are standardized and must offer the same coverage (for example, Plan G in California must offer the same coverage as Plan G in Texas). However, some insurance companies may offer additional benefits.

Medicare will remain primary payer which allows the Medicare beneficiary the freedom to go to any doctor/hospital in the nation that is contracted with Medicare! No need to worry about networks or referrals.

Barbara who has a heart condition is enrolled into a Medicare Supplement Plan G. She needs to see her cardiologist a few times a year. In January, she goes to her first doctor visit for the year. The specialist bills Medicare, which pays 80% of all approved services. Barbara’s Supplement Plan G picks up the 20% balance. Since it was Barbara’s first appointment of the year, she will be subject to her deductible.

Once Barbara has met her $240 deductible, she will then be covered for all Medicare approved services. This means she doesn’t have to worry about any doctor copays or out of pocket expenses. Even if she needed to have a surgery, Medicare will cover 80% and her Plan G will cover 20%. Barbara would pay ZERO!